Aloha, Mele Kalikimaka & Happy Holidays!

Tax Reform is Here!

If you are in the market to buy a new home or sell your current home this month’s Hawaii Damon newsletter is a must read. The new tax reform starting in 2018 will definitely affect the real estate market in general – the reasons for which it will have a bigger impact in Hawaii compared to the US average – will be explained. I will delve into how it could impact your bottom line and how to possibly and strategically reduce your tax burden vis-a-vis the new and existing tax rules*. We will first look at the MID (Mortgage Interest Deduction) newly limited to $750,000 on a new home loan which is down from $1,000,000. We will then look at the new property taxes in Hawaii (starting in 2017) and how they could specifically affect investment properties (non-principal residencies, rental property etc.). Finally we’ll look at capital gains taxes for which the rules, thankfully, will not be changed by the new tax reform. I’ll briefly go through the rules and and give some strategic advice if you are one of the lucky (or unlucky depending on how you look at it!) individuals that will be subject to high capital gains when you sell your home*. At the end of this month’s main article I will briefly talk about where I think mortgage interests rates are heading in 2018. Knowledge is Wealth so please read on!

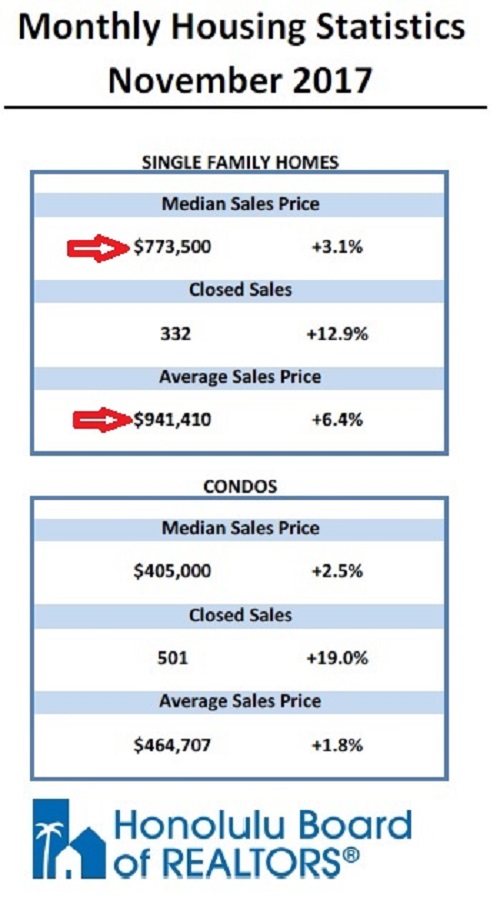

Hawaii Median & Average Home Prices – Median home prices in Hawaii are now over 3 times the US average. Here are the stats courtesy of the Honolulu Board of Realtors comparing Nov 2016 to Nov 2017:

The median price has now reached $773,500 as of November whereas the average median price in the US was only $247,000 (For a more detailed statistical analysis please see the last section below of this month’s newsletter). This fact makes lowering the MID (mortgage interest deduction) cap really matter here in Hawaii since the median prices of homes are already higher than the MID cap (again, it is not retroactive so current home loans up to $1M will be grandfathered in unless they are refinanced).

The median price has now reached $773,500 as of November whereas the average median price in the US was only $247,000 (For a more detailed statistical analysis please see the last section below of this month’s newsletter). This fact makes lowering the MID (mortgage interest deduction) cap really matter here in Hawaii since the median prices of homes are already higher than the MID cap (again, it is not retroactive so current home loans up to $1M will be grandfathered in unless they are refinanced).

MID (Mortgage Interest Deduction) – If you buy a new home in 2018 and finance it, your MID will now be limited to a mortgage interest deduction cap of $750,000 in loan financing whereas before it was a $1,000,000 cap. Under the old rules, say you purchase a home for $1,176,500 with a 15% down payment and the remaining $1,000,000 via loan at 4% interest. Your mortgage payment would be $4,474/month or X 12 = $57,288 per year. Of this amount in the first year of the loan the amount applied to mortgage interest and principle would be $39,680 and $17,610 respectively.

Under the old rules the entire $39,680 could be deducted from your income before paying taxes. This amounts to be an incredible incentive for home ownership. Under the new rules now and using the same example above, the cap on your mortgage interest deduction would be a loan of $750K ($250K less) so you no longer get the MID on $250K of the original $1M loan. This would impact your yearly MID by reducing it to 75% X $39,680 = $29,760. How would this affect your yearly bottom line? The general rule for lenders is that after taking on a new mortgage your debt to income ratio cannot be more than 40%. Working backwards on monthly loan payments of $4,474 X 12 months = $57,288 divided by 40% (.4) gives us a yearly income of at least $143,220 to qualify for such a loan. In all likelihood the individual or family described above would be in the $150K plus income tax bracket. Now assuming a 28% FED income tax bracket we get an effective loss of yearly income of 28% X $9,920 ($39,680 – $29,760) = $2,777.

This amount will probably not break the bank for the average family but it is not peanuts either, effectively adding up to an approximate 1.9% haircut on a yearly income of $150K.

How could home prices be impacted by this new lower MID cap in Hawaii? In order to avoid paying the extra tax as a result of the lower MID using the same 15% down example, the maximum home price threshold becomes $882,352 down from $1,176,500 ($882,352 home with a 15% down payment results in a loan of $750K which is the new MID cap). Families could try to save more to come up with a higher down payment for the more expensive home (if you are currently renting this would not be a winning strategy with average home appreciation rates of 4.6% (4.5% for condos) per year over the last 30 years – see Investors’ Guide Part IV (Jan. 2017). Rather – and most likely – we will see added pressure to an already red hot home market in this price range ($800K to $1.1M) where inventories are already at only 3.1 months (anything lower than 5 months is Sellers’ Market territory with increasing prices). Homes in the next price range ($1.1M to $1.9M) which currently has 5.6 months of inventory (5 to 6 months of inventory is considered the “Goldilocks Zone,” balanced in that it is not too hot or too cold i.e. neither Buyers nor Sellers have the upper hand), could possibly cool off just a little. Another very likely result is that the alternative condo market in the $700K plus range will see added price pressure as a viable alternative to owning a single family home (for a more detailed Buyers’ & Sellers’ Markets 101 including specific neighborhoods on Oahu please see last month’s newsletter).

Capital Gains Taxes – When you sell your home for higher than what you bought it for, the net gain is called a Capital Gain. In Hawaii with average home and condo prices appreciating at an average of 4.6% and 4.5% respectively, those accruing capital gains includes almost everyone. Under the old and current rules (no change) there is an exclusion of $250K for single home owners and $500K for married couples. This means that for married couples, let’s say you bought your home for $1,000,000 and sold it 10 years later (assuming average 4.6% appreciation per year) for $1,568,000 (renters take notice and see my first time home buyers video in the June Hawaii Damon Newsletter). Also, let’s say for simplicity sake, your closing costs and home maintenance repairs over the years added up to $68,000, then your entire net gain of $500K would have been exempt from capital gains. If it had not been exempt and depending on your exact tax bracket you could have paid between federal and state taxes approx. 31% = $155K – Ouch! Thankfully there is no change in the exclusion amount and the basic rule to qualify is that you have to have lived in your home for 2 of the last 5 years.

What if my Capital Gains on my property will be more than $500K? Let’s first call you lucky! However, in Hawaii – with average yearly appreciation of 4.6% (4.5% for condos) – you will be accompanied in your boat by a lot of other lucky people. Using the same example of a home bought for $1,000,000 and sold 18 years later, this time we come up with a $2,247,000 sales price and after the capital gains exclusion for a married couple ($500K) and some reasonable closing and repairs over the years (say $150K), your taxable capital gains would be $597,000 X 31%(approx.) = $185,070 – Ouch! However, do not despair as luckily there are other tax deferment and inheritance strategies one can employ to defer these taxes (first step would be to convert your primary residence to an investment property) all the way to heaven! (Please contact me for details – it is too complicated to give the topic justice in this brief newsletter*. It is also highly recommended that you consult an accountant, tax specialist before making any decisions.)

Hawaii Property Taxes – Now moving on to property taxes, in Hawaii we enjoy some of the lowest property taxes as a % of property value in the US for primary residences which is .35% per year. Using the simple example of a $1,000,000 (tax assessed value) home the yearly property tax would be $3,500. This % was unchanged in 2017. What has changed is the tax rate on 2nd home, investment and rental properties (Residential A classification). Up to $1,000,000 it is only .45% (still low e.g. statewide average for New York is 1.5%, over 3 times higher than Oahu) but then after that it climbs to .9% after the first $1M. This may still seem relatively low but with an average median price of 3 times the US average it can quickly add up. That $3M ultra luxury investment condo in Kakaako could cost you $22,500 ((.45% X $1M) + (.9% X $2M)) in yearly property taxes. Depending on what stage you are in life (empty nester etc.) and you are spending a lot of time in Hawaii, you may want to consider making your more expensive Hawaii home or condo your primary residence*.

Luxury Home & Condo Markets in Hawaii – How might they be affected? With the higher property taxes on investment properties over the first $1M(.45% on 1st $1M and .9% thereafter), it could possibly pour some (a little) cold water on extreme luxury above the $4M -5M level. More likely, instead of squelching investment, the investor considering the $3.5M condo may think twice and go for the $2.5M condo instead (the blended tax rate up to $3M – $4M level is still relatively reasonable considering the US avg.) or, alternatively, may consider converting his/her higher priced home/condo in Hawaii to the primary residence. For luxury single family homes (as opposed to luxury condos) over $1.9M there is still over 15 months of inventory (extreme Buyers’ market but, nevertheless, decreasing from last year), so there are some very good great value properties at the moment (please see the Great Value Luxury Home showcased in the next column of this month’s newsletter).

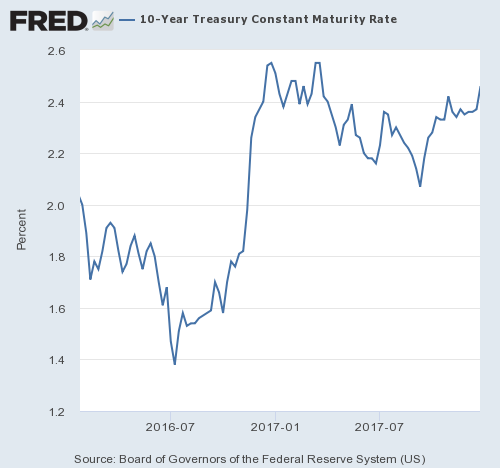

Interest Rates – I strongly feel that we have moved into a new economic paradigm of lower interest rates and lower inflation for reasons which I mostly covered in my September Hawaii Damon Newsletter (Quantitative Tightening). The FED will continue to slowly increase the FED Funds rate in the next year or few (maybe 2 to 3 increases in 2018 by only .25% each time) and there is no doubt that in the long term the FED Funds rate carries mortgage interest rates with it. However, short and medium term (as mentioned in previous newsletters) it is all about the 10 Year Treasuries (Bonds) and specifically their yields (interest rates) which compete with the home mortgage rates (the 30 yr rate is for the most part, a premium % on top of the 10 year treasury yields). Here is the most recent graph courtesy of FRED:

At the end of 2019 we can see it jump by around 1% coinciding with Trump’s election and the bond market speculating on tax reform (leading to a higher GDP growth %) and inflation. A year later we are getting some of the former and very little of the latter so we can see the 10 Year Treasury yield lowering during 2017 and sort of leveling out now. As a general rule, currently add about 1.6% to the 10 Yr treasury (so if 2.4% treasury yield then add 1.6% = 4%) to get the approx. 30 year mortgage rate. Then depending on your credit rating negotiate the best deal possible with your bank /mortgage lender!

The Take Away – Yes, the decrease in MID cap as described above will cause the under $1.1M housing market to heat up more than it already is. It may just cool off (by a very small amount) the $1.1M to $1.9M market while also heating up the market for condos over $700K as a viable alternative to a single family home. The higher property taxes on Residential A over $1M (investment, 2nd home, rental properties but not primary residences which enjoy some of the lowest property tax rates in the US), could throw a little cold water on the above $4M to $5M level but everything else should be, more or less, unaffected. Along with interest rates at historical low levels – and at least continuing that way for the next (at least) couple of years (bar any unforeseen cataclysm) – should all combine to portend a robust property market in Hawaii for the foreseeable future. Look for more condo development in the Kapiolani corridor to help the shortage of housing in the median housing markets and if and when the stock market cools off just a little, look for more investment from off-shore buyers (incl. US mainland) in the higher end Hawaii market (it sounds counter-intuitive but when the stock markets cool off a little (lesser gains), real estate, precious metals etc. become viable alternative investments).

Conclusion – Be it a first time home buyer, trading up or down, or as an investor – it is really a great time to be in the Hawaii Real Estate Market. If you are currently in a median neighborhood in Hawaii (Sellers’ Market) and are thinking of trading up to a luxury neighborhood (Buyers’ Market), it does not get any better than this. If you are an off-shore buyer, Hawaii is an investment paradise. If you have any questions regarding real estate strategy please do not hesitate to contact me as it would be my pleasure to serve you in your Hawaii Real Estate needs. Please pass this newsletter along to any friends and family or they/you can sign (them) up here.

Happy Holidays, Merry Christmas, Feliz Navidad, Happy Hanukkah & Especially Mele Kalikimaka!

Aloha!

Damon