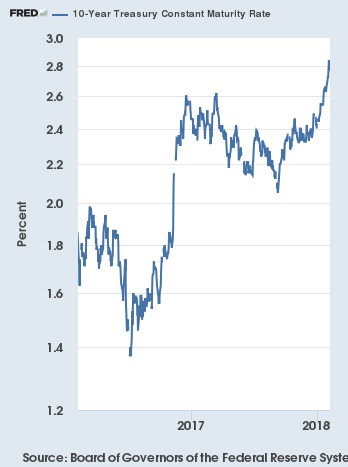

Interest Rates – I strongly feel that we have moved into a new economic paradigm of lower interest rates and lower inflation for reasons which I mostly covered in my September Hawaii Damon Newsletter (Quantitative Tightening). The FED will continue to slowly increase the FED Funds rate in the next year or few (after one this month, maybe 2 more increases in 2018) by only .25% each time) and there is no doubt that in the long term the FED Funds rate carries mortgage interest rates with it. However, short and medium term (as mentioned in previous newsletters) it is all about the 10 Year Treasuries (Bonds) and specifically their yields (interest rates) which compete with the home mortgage rates (the 30 yr rate is for the most part, a premium % on top of the 10 year treasury yields). Here is a recent graph courtesy of FRED:

At the end of 2016 we saw it jump by around 1% coinciding with Trump’s election and the bond market speculating on tax reform (leading to a higher GDP growth %) and inflation. In 2017 we can see the 10 Year Treasury yield leveling out and now increasing again coinciding with the expectations of tax reform coming to fruition. Rates are historically low still and I will continue to make updates in upcoming newsletters. As a general rule, currently add about 1.6% to the 10 Yr treasury (if treasury yield is 2.5% then add 1.6% = 4.1%) to get the approx. 30 year mortgage rate. Then depending on your credit rating negotiate the best deal possible with your bank /mortgage lender! As of this writing Myers Capital Hawaiishows a 30 Yr Fixed rate of APR 4.148%.

Aloha!

Damon