Aloha!

What are the best Strategies for both Buyers and Sellers in our current Real Estate Market in Hawaii? Furthermore, what is the current situation of our market? Understanding the fundamentals of the latter question will help us answer the first question. Also, the strategies will differ depending on each individual or family circumstances and I will try to get thru the main ones e.g. trading up from a median neighborhood to a luxury neighborhood, up-sizing, down-sizing, first time home buyer, condo vs single family home etc. to briefly name a few. I will also provide tips for getting the best fair price for your home if you are a Seller and ways to seek out great value if you are a Buyer. Therefore, I will divide this Market Strategies topic into 2 Parts focusing on Buyers this month and then Sellers in next month’s newsletter which I plan to have out early by the 2nd week of July. (Sellers, there will be some pertinent and general Economic-Real Estate Market related info for you in this month’s newsletter so please read on and I have some easy homework for you at the end). Let’s first review some important general real estate market info relevant for both Buyers and Sellers. Most importantly let’s keep in mind that if your situation is unique and not fitting into one of the broad categories reviewed here, please do not hesitate to reach out to me, Damon Rhys.

First, let’s look at the current Hawaii Real Estate Market in terms of Buyers’ and Sellers’ Markets. Presently we are experiencing a tale of two towns in extreme Buyers’ and Sellers’ Markets conditions. Median priced neighborhoods are hot with prices rising and inventories continuing to fall. The Median Sales Price for a single family home on Oahu was $745,000 (3 times more than the US national average) last month (May 2017) representing a 3% increase from the same month last year. Inventory dropped to 2.7 months (the amount of time it would take on average for all the homes currently on the market to sell-out) and to put this number in perspective a healthy balance (neither Sellers’ nor Buyers’ Market) would be 5-6 months of inventory. Therefore, these Median neighborhoods are squarely in Sellers’ Market territory. On the other hand, the luxury home neighborhoods – defined as homes over $1.9M – are looking at 15.6 months of inventory (down from 17.9 months in May 2016 but still high) with an original listing price to average final sales price ratio of 90.9% e.g. a home originally listing for, say $2,000,000, would have sold – on average – for $1,818,000.

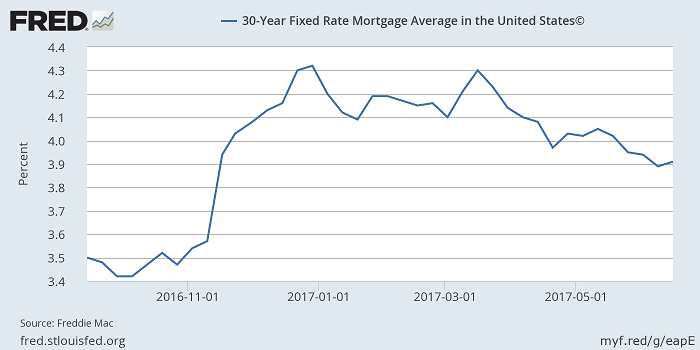

Secondly, before delving into the strategies, let’s briefly look at interest rates – an important piece of the puzzle – and where they are now and may be heading. Didn’t the Fed just raise the Fed Funds interest rate last week for a total of 3 times from December 2016? Given so, mortgage interest rates should also be increasing, right? Wrong:)! They are actually decreasing again as you can see from the following chart:

After the initial bump in mortgage interest rates after Trump’s election in November, we can see rates falling again from the beginning of 2017 despite the 3 recent Fed Funds interest rate increases. In my Economic Predictions for 2017 – Dec 18 Newsletter I addressed the fear of seeing rapidly increasing mortgage interest rates but predicted we would stay just moderately above 4% average rates for most of 2017. The good news for both Sellers and Buyers is that mortgage interest rates have now actually fallen below 4% with one local Mortgage Lender reporting rates as low as 3.665% APR for a 30 Year Fixed (Myers Capital). Why this is actually happening I covered in my previous Kakaako Rising & Interest Rates Falling – April 23rd Newsletter so I will not delve into it here – long term the Fed sets the bottom range of the scale but in the short to medium term the 10 Year Treasury yields set the barometer for mortgage interest rates. Nevertheless, falling mortgage interest rates – at least temporarily – are good for both Buyers and Sellers.

Buyers

First, full disclosure – My brokerage firm is Sachi Hawaii Pacific Century Properties and our Island is Oahu. Though I am familiar with all neighborhoods on the island, I tend to specialize in East Oahu including condos in Kakaako-Ala Moana-Waikiki to the well known luxury home areas (Kahala, Hawaii Loa Ridge, Portlock etc.) and to Hawaii Kai in the very East (Kailua/Lanikai Windward neighborhoods are also recent areas of interest). That being said, my advice tends to be geared towards the areas of my East Oahu expertise. Nevertheless, when it comes to pricing (determining what would be a good fair price from the Buyer’s perspective i.e. when I am wearing my Buyer’s hat) – my quantitative analysis would work anywhere on the planet so if you need to know if the property you are interested in, say on the North Shore, is fairly priced then please do not hesitate to ask me.

Scenarios: (again if I do not cover your particular scenario in this newsletter please don’t hesitate to reach out to me, Damon Rhys)

First Time Buyers – Simply said, “don’t wait!” – especially if you are currently paying rent. Here is a quick video for you:

When you pay rent you will never see your hard earned money again. When you buy a property no matter how small or even if it is just a one bedroom condo, you are essentially putting money in the bank and building equity. It might not be exactly where you want or the size or number of rooms you want but you can make do and be “cozier” than you expected for a couple or few years. When I was living in Japan as an exchange student I lived in a 10′ by 10′ foot room with a bathroom that made an airplane lavatory seem spacious by comparison! You probably don’t need to be this “spartan” but stop throwing away your money and start building equity! Scrape and kick – do what you have to do – to save up for the most minimal down-payment (even if it means moving back in with your parents for a few months – they will still love you!:) I would be more than happy to review the many options you probably don’t know you already have – with you.

Luxury Home Buyers – It is actually a good time to be in the market for a luxury home. Inventories are high (15.6 months as of this writing) with prices decreasing in many Oahu Luxury Home neighborhoods. Here is a brief video for you:

As mentioned in the video, it’s a Buyers’ Market in most of the luxury home neighborhoods on Oahu. Final sales price to listing price ratios are running around 90% (10% less) e.g. a $3M home listing is eventually selling – on average – for about $2.7M. If interested in one of these areas please reach out to me and I will send you a list of everything on the market. (Luxury Home Sellers, if you are reading this, please do not despair! I’ll address great strategies for you next month to find the right buyer).

Median Home Neighborhood Buyers – As of May 2017 Oahu’s Median Single-Family price was $745,000 and for condos it was $406,500. This is approximately 3 X the US average. This market is very hot now with inventories in the 2 months range (again, 5 – 6 months would be a neutral market) so it is a Sellers’ market. Short of paying cash, there are strategies Buyers can pursue to make their offers stronger than other competing offers. Increasing the cash to loan ratio, making a higher down payment, having a pre-approval loan letter as opposed to a pre-qualification, and having a well written cover letter to accompany your offer – are all proven methods for successfully winning. Note that the average final Sales Price to Listing Price ratio for the Median Price Home was nearly 99% for May 2017 meaning your offer is going to have to come very close to the asking price in most cases. Another alternative to the 3 bedroom home would be to consider, perhaps temporarily, a 2 bedroom semi-luxury condo. For a family of four it may be a bit “cozy” but hopefully the great amenities the condo has to offer will make up for the lack of space. Instead of heading into battle in a Seller’s Market you would have the wind at your back and sail into a Buyer’s Market for condos $700K and up (condos in the $475K-$700K range would be luke warm Sellers market). Later, when the Median Single-Family market cools off at some point, you could always trade up.

Families & Education – I have a 5 year old son and he will be starting Koko Head Elementary in August. I am not sure when the rest of the state will follow suit but all the public schools in Hawaii Kai have implemented the IB (International Baccalaureat) system now (the last school to implement, Koko Head Elementary for all intents and purposes has implemented IB already and is scheduled to get its accreditation next year). The IB is the same system as many private schools have in town. However, in Hawaii Kai we are talking about the public school system. Also, with the Kalanianaole Hwy contra-flow lane in place, commutes to town in the morning for working parents can be done in as little as 30 minutes. Please check out the August 2016 Blog on my website discussing the IB with links to the official IB website. Education is something to seriously consider when buying a new home.

Trading Up – Thinking of trading up from a Median Neighborhood to a Luxury Neighborhood? I know many of you reading this letter as my clients are seriously considering this move. Basically you would be selling in a hot Sellers’ market getting top dollar for your Median Neighborhood home and buying into a Buyers’ Luxury Home Market able to negotiate the best possible Luxury Home price. There is not really much to explain here other than it doesn’t get better than this! I would be more than happy to assist you on both sides of this move.

Investors – I wrote a Four Part series dedicated to this topic which is posted on my blog site. I will include the link to Investor’s Guide Part 1 here which has a link at the bottom to the next Parts in sequential order. The first 2 parts are written from an “Overseas Investors” perspective – though may still make interesting reading for the Local Investor – and Parts 3 & 4 apply to everyone. In Part 4 I include a graph showing average annual appreciation rates for homes and condos respectively over the last 30 years to be 4.6% and 4.5%. Yes, especially and definitely from the appreciation perspective, buying property in Hawaii is a good investment. I have a lot of strategies, too many to explain in this brief newsletter. Depending on your individual situation I would be more than happy to further discuss in detail.

Home or Condo? – This takes some serious consideration depending on you or your family’s lifestyle and situation. This topic was covered in the Hawaii Damon March Newsletter. Please check it out.

Did I miss anything pertaining to your particular situation? If you believe so please give me a call!

Sellers

It is wise to know good strategies for Buyers as more likely than not you will be parlaying your sell into another home purchase – either up-sizing or down-sizing depending on your progressing life situation and lifestyle. In Part II which I promise to have out early next month (during the 2nd week), I will outline important strategies to follow so as to find the “Right Buyer” (as opposed to “Any Buyer”) for the best fair market price for your home. In the meantime, your homework is to find out a good estimate of your home is currently worth by following this link (it’s free!):

www.hawaiidamon.smarthomeprice.com

Aloha – Damon