APRIL 2020 OAHU HAWAII REAL ESTATE STATISTICS (MARCH DATA) & ANALYSIS | BY DAMON RHYS

Posted

Aloha! Here are the April 2020 (March Data) Oahu Hawaii Real Estate housing statistics courtesy of the Honolulu Board of Realtors – Hawaii Housing Stats, March 2020. In 2019 we have saw price increases slow down to the point wherein in several months of the year, prices actually decreased. In June closed sales have actually fell by double digits %s compared to the year before. Many had been wondering if we had reached the peak of our economic and trailing real estate cycle.

GREAT VALUE HAWAII LUXURY REAL ESTATE | UPPER MANOA HOME & A’EO Condo | April 2020 by Damon Rhys

Posted

In this month’s Great Value Luxury we will showcase both a beautifully remodeled Modern Style A-Frame home in Upper Manoa Woodlawn Neighborhood and a one bedroom condo on the 27th floor of the Ae’o Building in the prestigious Ward Village – both with great value asking prices and rental income potential.

Covid-19’s Effect on Hawaii Real Estate Market

Posted

What is going to be the effect of Covid-19 on Hawaii Real Estate Market? As we all know a major component of the economy in Hawaii is tourism and world wide it has ground to a halt. In a previous newsletter I had predicted that a very light recession at the beginning of 2021 would occur and it looked like we were on that trajectory. That is until Covid-19 hit us. The reality is now a worldwide recession caused by the WWIII Covid-19 war we are fighting. The recovery will also be similar to what has been experienced after the occurence of major or previous world wars.

GREAT VALUE HAWAII LUXURY REAL ESTATE | PINNACLE CONDO & LOWER WAIALAE IKI | July 2019 by Damon Rhys

Posted

Welcome to the Summer 2019 Great Value Hawaii Luxury Real Estate section featuring both Homes & Condos which we think offer especially great value for potential Buyers. The first property showcased here, listed by Damon Rhys – Sachi Hawaii, is an ultra-rare half floor (17A) 3 bedroom unit in Downtown Honolulu’s prestigious “The Pinnacle” building. Built in 2008, this unit is situated in the favored “A” units facing Diamond Head and the Ko’olaus. With only two units per floor; arrive home to luxury with FOB secured elevator opening into your own private foyer.

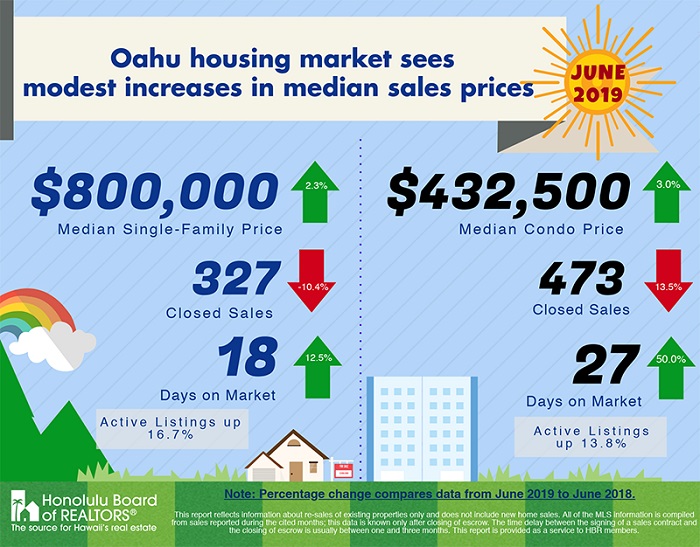

JULY 2019 OAHU HAWAII REAL ESTATE STATISTICS (JUNE DATA) & ANALYSIS | BY DAMON RHYS

Posted

In 2018 the housing market on Oahu continued to break median sales price records on a monthly basis, compared to the previous year, with overall prices having increased on a monthly basis for both homes and condos (the notable exception would be the luxury home market). However, in 2019 (actually starting in Dec last year) we have seen price increases slow down to the point where in 3 months so far this year, prices actually decreased.

Bill 89’s Impact on Hawaii Real Estate

Posted

Knowledge is Wealth! So would be a round-trip time-travel ticket to 1986 when the DPP (Department Planning and Permitting) first started issuing NUCs (Non-conforming Use Certificates) for homes and condos outside of resort areas - as a temporary solution - in order for them to legally engage in B&B (Bed & Breakfast) and TVU (Transient Vacation Unit) rentals; collectively known as STR (short term rentals) businesses. During the Honolulu Board of Realtors Agent Forum on July 11th, addressing Bill 89 - the City Council's solution for the contentious and prolific STR businesses -

Hawaii Real Estate Market – Losing Some Steam?

Posted

Knowledge is Wealth! So would be a round trip time travel ticket to 2029 for a day and then back to 2019 again. Imagine all the possibilities; stocks, real estate, precious metals etc. you could invest in knowing what would give you the highest rate of return and make you wealthy. There are certainly a few buildings and single family home neighborhoods on Oahu that I would have liked to have invested in - now with hindsight 20/20.

2019 Hawaii Real Estate Predictions! & The 4 Important Rates to Know for Wealth

Posted

Knowledge is Wealth!As mentioned in the above main article, so would be beforehand knowledge of the 4 Rates that can both create and moderate wealth. These rates are Interest Rates,…

Latest Oahu Areas Analyses – Buyers’ or Sellers’ Markets?

Posted

Knowledge is Wealth! The topic of this month's newsletter is meant to be an important update of the May 2018 Buyers' or Sellers' Market Analyses for many neighborhoods on Oahu. For both Buyers and Sellers it is important to know if you are buying or selling in a Buyers' Market or Sellers' Market - strategies should be planned accordingly!

GREAT VALUE HAWAII LUXURY REAL ESTATE | Waialae Iki Home & Esplanade Condo | Jan 2019 by Damon Rhys

Posted

Welcome to the Winter 2019 edition of our Great Value Hawaii Luxury Real Estate where feature both Homes & Condos which we think offer especially great value for potential Buyers. The first property we showcase is a luxury home on Lower Waialae Iki Ridge on the quiet and exclusive Ehupua St. Originally built in 1962, it was remodeled in 2015 and features a single story layout with sweeping panoramic Ocean and Diamond Head views. The second property showcased here is a Citadel-in-the-Sky 2 bedroom unit in the renowned Esplanade Complex situated right on Koko Marina.